Online Gratuity Calculator UAE 2026 – Calculate End of Service Benefits (EOSB)

Confused about your gratuity amount?

Numbers often don’t match what HR shares, and most calculators explain too much but answer too little. This page exists to give one clear number, based on current UAE labour rules, without guesswork. Enter your details and see the breakdown instantly.

Estimate your end of service gratuity based on basic salary and service period.

What is Gratuity Calculator UAE Online?

The Gratuity Calculator UAE Online is a smart digital tool that helps employees calculate their end-of-service benefits (EOSB) according to the latest UAE Labour Law (Federal Decree-Law No. 33 of 2021). It provides an instant estimate of the gratuity amount you are entitled to receive in your full and final settlement after leaving a job in the UAE.

UAE Gratuity Calculation Breakdown

No hidden steps. No rounding tricks. Each part shows exactly where the number comes from.

How to Calculate Gratuity in UAE

Gratuity in the UAE is calculated using your basic salary and total years of service, following the formula set under UAE Labour Law.

Here’s the official calculation method:

21 Days Rule (First 5 Years)

For each of the first five years of service, gratuity is calculated at:

21 days of basic salary per year

30 Days Rule (After 5 Years)

For every year beyond five years, gratuity is calculated at:

30 days of basic salary per year

Basic Salary Only

The calculation uses your basic monthly salary only.

Maximum Gratuity Cap

The total gratuity amount cannot exceed two years of your basic salary, even if your service exceeds that period.

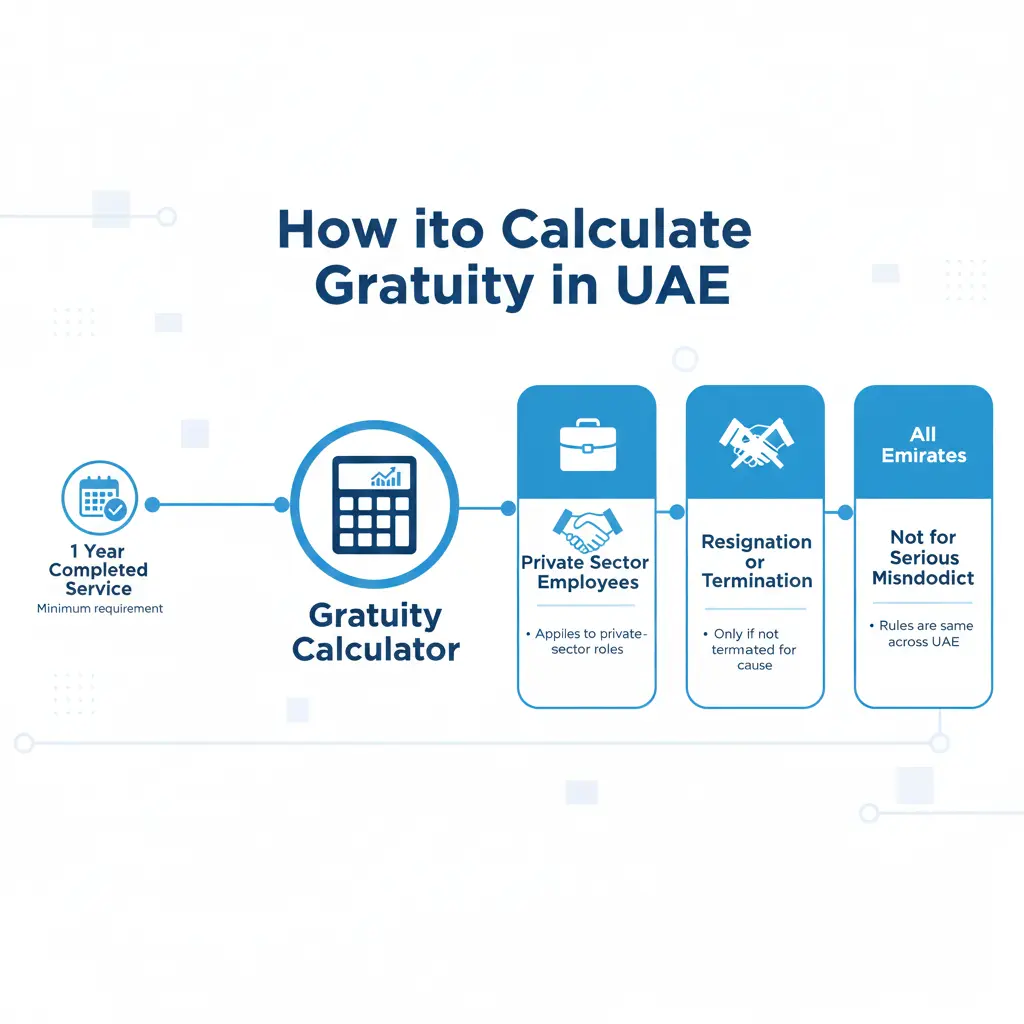

Who Is Eligible for Gratuity in UAE?

Under Federal Decree-Law No. 33 of 2021, regulated by the Ministry of Human Resources and Emiratisation, gratuity applies to private-sector employees who complete at least one year of continuous service.

It covers both resignation and termination, provided the employment does not end due to serious misconduct as defined by UAE labour regulations. The rule applies consistently across all Emirates.

Employees should ensure their UAE Labour Card status is active and properly registered before final settlement processing.

You’re Eligible If:

1 Year Completed Service

Your service must reach one full year with the same employer.

Resignation or Termination

Gratuity applies whether you resign or your employment ends, unless dismissal falls under legally defined misconduct.

Private Sector Employment

These rules apply to private-sector roles governed by UAE labour law.

Employment Anywhere in UAE

The benefit applies to employees working in Dubai, Abu Dhabi, Sharjah, and all other Emirates.

This keeps gratuity eligibility in the UAE clear, consistent, and predictable, regardless of where you worked or how your service ended.

What Is Not Included in UAE Gratuity

Allowances

Housing, transport, other monthly allowances aren’t included.

Bonuses

Performance or annual bonuses don’t form part of gratuity.

Overtime

Extra hours worked don’t affect the calculation.

Commission

Sales or incentive-based earnings stay out.

UAE Gratuity Calculation Examples

Example 1: 2 years of service

Basic salary: AED 5,000

Daily rate: 5,000 ÷ 30 = AED 166.67

Gratuity: 2 × 21 days × 166.67 ≈ AED 7,000

Example 2: 6 years of service

Basic salary: AED 8,000

Daily rate: 8,000 ÷ 30 = AED 266.67

Gratuity: (5 × 21 days + 1 × 30 days) × 266.67 ≈ AED 36,000

Example 3: Partial year service

Basic salary: AED 10,000

Service: 4 years and 6 months

Gratuity is prorated for the extra months, not rounded off, and added to the total based on the same daily rate.

Gratuity Calculator for Dubai, Abu Dhabi & All UAE

This gratuity calculator in UAE works for employees in Dubai, Abu Dhabi, Sharjah, and across all Emirates. Whether you’re checking figures for a gratuity calculator Dubai use case or a gratuity calculator Abu Dhabi scenario, the rules stay consistent nationwide, so the result follows the same calculation logic everywhere.

FAQs UAE Gratuity

Disclaimer

This calculator is for informational use only. It provides an estimated gratuity amount based on the details you enter and current UAE labour rules. It’s not legal advice. For disputes or official clarification, refer to MOHRE or a qualified UAE labour professional.